Financial Planning, Superannuation

The Valuation Conundrum: Valuing Unlisted Assets in Australian Superannuation Funds

29 September 2023

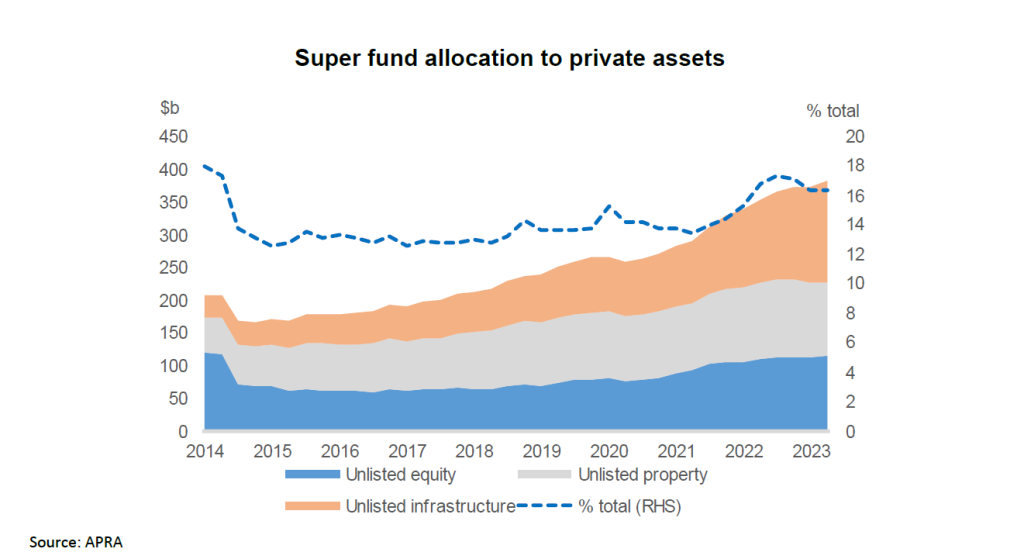

Unlisted assets have played an increasingly important role amongst industry super funds. As of June 2023, the average proportion invested by industry superannuation funds in unlisted assets was 16.4%, with approximately 4.8% allocated to both unlisted equity and direct property and 6.7% to unlisted infrastructure. In comparison, Australia’s largest superannuation fund, Australian Super, currently holds 26.6% of its portfolio in unlisted assets, of which 4.8% (the industry average) is in unlisted property. We note that another heavyweight in the super world, that supports the construction industry, Cbus, has the highest exposure to property of any of the major industry funds, with 11.2% of assets invested in the sector and 27.4% in unlisted assets collectively.

These are material and sizable holdings and a key point of difference versus small investment funds which do not have the scale to internally manage such assets at these levels. The larger industry super funds certainly have the size and time horizon to absorb these investments, but the question is do they have the internal expertise and the collective will to value these assets in a timelier fashion and out of cycle during volatile periods? We note that Cbus made the headlines recently, after writing down some of its commercial property interests by as much as 10% whilst other funds have not yet done so. Is this cause for alarm?

Whilst the long-term investment case behind an investment in unlisted assets is not in dispute, the valuation methodologies employed by super funds have come under question recently by the regulator, Australian Prudential Regulation Authority (APRA), and for good reason. Up-to-date valuations, as we know, are a key input into the calculation of accurate investment performance, which in turn is fundamentally important in ensuring that investment earnings and returns are fairly distributed amongst the members of the superannuation fund.

The challenge, however, is that historically the big super funds have approached the task of valuing unlisted assets in different ways, both internally and via the use of independent external valuers. But some value quarterly with many more valuing their unlisted assets semi-annually and in some cases as little as once a year.

Critiques of super fund valuation practices came to the fore during the COVID-19 pandemic in 2020. Concerns arose about super funds’ liquidity to fulfill government-mandated early release schemes due to their heavy reliance on illiquid, unlisted assets. Later in 2022, the issue came to a head again when a substantial performance gap was evident between publicly listed commercial property funds and unlisted property funds.

Unlisted property, mostly office and retail, remains a relatively large component of the unlisted asset mix for super funds. As illustrated in the chart below, the listed Australian Real Estate Investment Trust Index (A-REIT), which is priced daily, experienced two significant downturns in 2020 and 2022. In contrast, unlisted property, represented by the red line, navigated these volatile periods relatively unscathed, primarily due to their infrequent pricing compared to their listed counterparts.

Another criticism of super funds’ valuation practice concerns the assumptions applied when valuing unlisted assets. Property and infrastructure assets are typically valued using a discounted cash flow model, which projects future earnings and applies a discount rate based on the long-term bond yield. However, the determination of what this discount rate should be is highly subjective with differences leading to a wide range of present values once applied. The risk of using a low discount rate is overstating the asset valuations, disadvantaging new members entering a fund with artificially inflated valuations, and potentially benefitting existing members who choose to redeem or switch into other low risk options.

A similar issue arises in valuing unlisted properties, where it is common practice to assume full occupancy and then calculate future rents while applying a discount rate (again the 10-year bond yield). However, with the popularity of working from home over the past couple of years, the assumption of full occupancy could potentially be well off the mark leading to an overstatement of property values over the short to medium term.

More recently, APRA undertook a case study review of super funds invested in Canva (a private equity technology company) and examined their valuation approaches. APRA concluded that there were inadequate revaluation triggers in valuation policies, gaps in Board skillsets (with respect to valuation), and worryingly, a “lack of consideration of the

expected performance and unit price impact of valuation decisions”. Clearly, the super industry has much work to do to get their house in order according to APRA.

The Regulator’s Response: APRA’s Prudential Standard SPS 530

In response to industry concerns and the inherent challenges associated with valuing unlisted assets, APRA revised prudential standard SPS 530 following a period of industry consultation, aimed at elevating the valuation practices of unlisted assets within superannuation funds. The refreshed standard came into effect on the 1 January 2023.

SPS 530 mandates that superannuation funds establish robust valuation governance frameworks to effectively manage valuation risk. These frameworks encompass structures, processes, procedures, and controls to ensure accurate and unbiased asset valuations. A core requirement of these frameworks is the emphasis on independence in the valuation process, reducing potential conflicts of interest, and ensuring objectivity.

The standard also expects superannuation funds to conduct valuations at least quarterly, with additional valuations to be made during periods of market volatility or significant policy changes. This more frequent approach aims to prevent assets from being valued at stale prices, ultimately ensuring fairness for all fund members.

The Super Industry Response

Many funds have responded to APRA’s prudential practice guide by sharpening their focus on valuing unlisted assets, improving liquidity management practices, and stress-testing their portfolios – a positive development. While APRA’s expectations are abundantly clear, practical challenges remain.

Despite the introduction of SPS 530, valuing unlisted assets remains a complex undertaking. For this reason, APRA is not entirely prescriptive, which opens some of APRA’s best practice principles to interpretation and/or at the discretion of super funds if there are good reasons for not complying.

Other practical challenges remain:

• Illiquidity: Unlisted assets inherently lack liquidity, making accurate market value in the absence of a liquid market extremely difficult.

• Limited Comparable Data: Unlisted assets often lack extensive market data and comparable transactions, complicating benchmarking.

• Valuation Methodologies: Different asset classes require distinct valuation approaches.

• Independence and Conflicts: Maintaining independence in valuation processes is critical, but conflicts of interest may arise.

• Timeliness: Conducting valuations promptly during volatile market conditions remains a logistical challenge for many funds.

Nevertheless, most super funds, appear to be on board at least with the spirit of the guidelines notwithstanding the practical obstacles they now face.

The Road Ahead

APRA’s introduction of prudential standard SPS 530 represents a significant step forward in addressing some of the shortcomings in the valuation practices of unlisted assets by industry super funds. While practical obstacles may persist, APRA’s desire and the super industry’s commitment to enhancing transparency, accuracy, and fairness in valuations is long overdue and a welcome development. Ongoing efforts by the regulator and industry to improve valuation practices will undoubtedly contribute to better outcomes for all.

Contact Cambio Group to review your superannuation fund and ensure your investment strategy is well thought through and considers the unlisted asset allocation.

Disclaimer: The information (including taxation) in this website does not consider your personal circumstances and is of a general nature only – unless otherwise stated. You should not act on the information provided without first obtaining professional advice specific to your circumstances.

The above material has been reprinted with the permission of Quilla Consulting Pty Ltd (Quilla).

A full compliment financial services group with 1 simple mission:

to deliver positive change in the lives of our clients

For over 20 years we’ve been helping people like you make smart, informed business and financial decisions. We’re in this to make a difference, to help you avoid the common mistakes that prevent people from building a business and creating a life they truly love.