While there’s no share market crystal ball, these real-time volatility indexes provide a gauge on investor sentiment about the future.

Daily fluctuations in individual share prices are totally normal, but when share markets as a whole become more volatile it can be quite unsettling for many investors.

It should come as no surprise that there isn’t an accurate way to foretell what share markets will do from one day to the next.

Overnight changes on international share markets can indicate the likely general direction of the Australian share market over the next trading session. But there are no guarantees. Markets are highly unpredictable.

However, while there is no share market crystal ball as such, there are a number of indexes that effectively track markets volatility based on what investors think may happen on share markets over the near term.

As well as being tradeable indexes – they can be bought and sold via exchange traded fund (ETF) products on share and futures markets – they’re forward-looking barometers that can be used as a way of gauging markets sentiment about the future.

Below are four key volatility tracking indexes that many traders and investors follow.

The U.S. fear index

Arguably the most widely known measure of investors’ volatility expectations is the VIX – the Chicago Board Options Exchange’s CBOE Volatility Index – which is often referred to as the U.S. markets’ “fear index”.

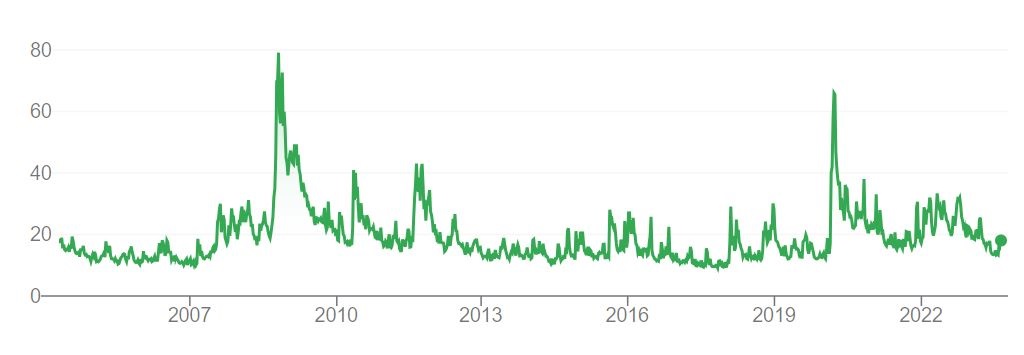

The VIX is a real-time tradeable index that tracks the magnitude of price changes on options contracts covering the United States’ S&P 500 Index which are due to expire within the next 30 days. Large price swings in expiring options contracts, either up or down, indicate expectations of greater volatility in the S&P 500 Index.

A higher VIX reading is indicative that investors expect increased market uncertainty, while a lower reading indicates expectations of lower U.S. market volatility.

Share market volatility spiked in 2022 amid economic concerns, particularly around surging inflation levels and the impact of rising interest rates. Those economic concerns remain, although the VIX has trended lower over the course of 2023.

The VIX is still well below its levels in the lead-up to the 2020 COVID market crash and those recorded in the latter part of 2022.

Volatility heartbeat: How the VIX has moved over time

Note: CBOE Volatility Index 30 April 2004 to 16 August 2023.

Source: Chicago Board Options Exchange

Australia’s volatility index

The key market sentiment indicator for the Australian share market is the S&P/ASX 200 VIX (A-VIX).

It uses a similar calculation methodology to the VIX, tracking the price volatility of options covering the S&P/ASX 200 that will expire over the next 30 days.

Relatively higher levels of the A-VIX imply a market expectation of large changes in the S&P/ASX 200, while a relatively lower A-VIX value implies a market expectation of little change. As a result, the A-VIX will often move inversely to the equity market.

The VOLQ Index

The Nasdaq Stock Exchange launched the Nasdaq-100 Volatility Index Options (VOLQ) in 2020 to give professional traders a way to gauge expected market volatility by using the prices of Nasdaq company options contracts due to expire in four weeks’ time.

Traders can then use futures contracts to buy and sell the expected forward market volatility that has been calculated on the VOLQ.

The Skew Index

The CBOE Skew Index is a volatility indicator that also tracks options trading on the Chicago Board Options Exchange, and is used as a pointer to so-called “Black Swan” events — difficult to predict situations that have the potential to trigger a market correction.

When there’s more buying of downside protection options, the Skew indicates that traders are covering off their positions against a potential market downturn.

Does markets volatility matter?

Indexes that measure projected volatility are useful to a point. They can’t accurately predict future market movements, but they can be used a barometer because they indicate market trading sentiment.

For long-term investors, however, short-term sentiment around volatility and near-term returns is largely irrelevant.

Historical markets data shows that while volatility can impact returns over the short term, volatility generally has little impact on long-term returns.

That’s clearly illustrated by the 2023 Vanguard Index Chart, which covers the 30-year period between 1 July 1993 and 30 June 2023.

This period of time includes the Asian currency crisis in the late 1990s, the Dot.com crash in the early 2000s, the Global Financial Crisis in 2008-09, and the 2020 COVID market crash. All of these major events, and many smaller ones in between, triggered short-term markets volatility.

However one-off events are generally short-lived. Despite ongoing markets volatility, most investors who have held their investment course over the long term have been rewarded with capital growth and income returns over time.

Markets volatility can be distracting and unsettling. But successful investing revolves around having a well-planned and diversified strategy that’s aligned to your specific goals, and the discipline and resolve to stay the course, even during the most volatile investment times.

Work with Cambio Group’s Financial Planners

If you have any questions or would like some investment advice, please reach out to our team at Cambio Group. We are more than happy to help.

Get in touch today!

Disclaimer: The information (including taxation) in this website does not consider your personal circumstances and is of a general nature only – unless otherwise stated. You should not act on the information provided without first obtaining professional advice specific to your circumstances.

The above material has been reprinted with the permission of Vanguard Investments Australia Ltd.

A full compliment financial services group with 1 simple mission:

to deliver positive change in the lives of our clients

For over 20 years we’ve been helping people like you make smart, informed business and financial decisions. We’re in this to make a difference, to help you avoid the common mistakes that prevent people from building a business and creating a life they truly love.